25+ credit spread calculator

Web The rate spread calculator generates the spread between the Annual Percentage Rate APR and a survey-based estimate of APRs currently offered on prime mortgage loans of a comparable type utilizing the Average Prime Offer Rates fixed table or adjustable table. The spread between the two most popular classes of tranche and the ratio between the two spreads.

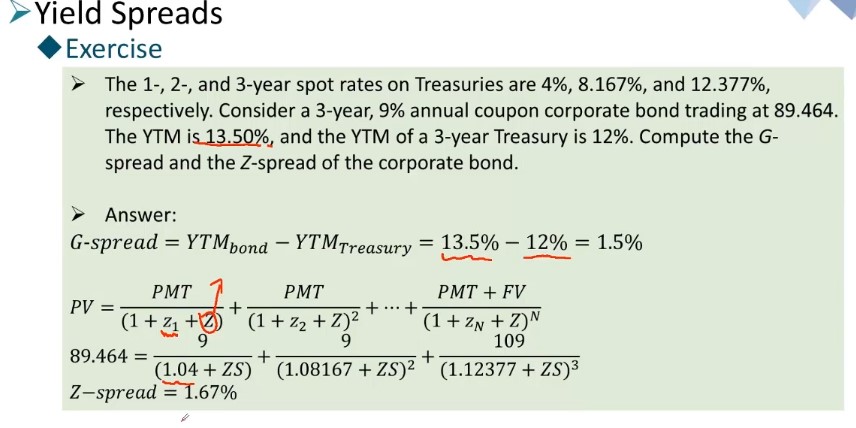

Z Spread Calculation Level 1 Quant Analystforum

All options have to expire at the same date Step 4.

. Credit spread corporate bond yield - government bond yield. Select your option strategy type Call Spread or Put Spread Step 2. The calculator is based on two important factors.

In the first example with the 5045 put spread you can see we collect a much more. Understanding the value of your pip is essential when managing risk. Government the spread can be used to determine.

Future Value of Annuity FVA Calculator. Ad Stay on top of bills keep funds organized crush your financial goals. Bull put spread Bear call spread Contracts.

Equivalent Annual Annuity EAA Calculator. Web Credit spreads commonly use the difference in yield between a same-maturity Treasury bond and a corporate bond. Web Annuity Payment Factor - Present Value PV Calculator.

120 020 Amount of SHARES you are. Free TrialNo Credit Card. Manage your finances with confidence ease.

Learn To Make Spread Income With Options. Web THE CREDIT SPREAD CAL Created by. Enter the option price and quantity for.

Enter the underlying asset price and risk free rate Step 3. Real Time Option Searches - Free. Web This is an even better way to think about the credit market and its pretty cool.

Real Time Option Searches - Free. The last step is to calculate the credit spread. If you were entering the trade in your brokerage platform as a spread this is the price you should enter to start with as.

Web Credit spread is the percentage of a persons credit that theyve recently used. As Treasury bonds are considered risk-free due to their being backed by the US. If you use credit you can get a loan even if you dont.

Future Value of Annuity Continuous Compounding. Try Simplifi for free today. Kleinhenz -- 2007 Bull Put Spread Sell to Open price of the option you are selling.

The probability for each is highlighted with a red box. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing. The Foreign Exchange Spread Calculator will help you calculate the value of a pip based on your currency pair and.

Web OLD Rate Spread Calculator generates the spread between the Annual Percentage Rate APR and the comparable treasury security utilizing the Treasury Securities of Comparable Maturity under Regulation C table action taken lock-in date. Web Calculate the credit spread. Cash needed for the trade.

Web Credit Spreads for Income Class Probability of Success Calculator Download the Spreadsheet AND Watch The Class Just enter your first name and email to receive the free Credit Spreads for Income Class Probability of Success Calculator. Web Credit Spread Calculator. Future Value Growing Annuity FVGA Payment Calculator.

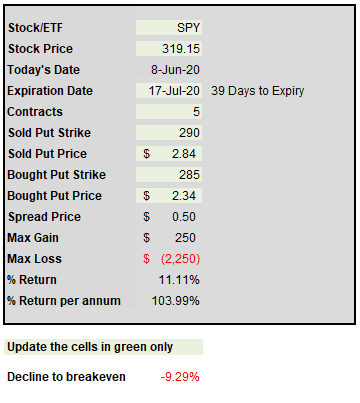

I dont know how I got here in the first place but a credit spread of 60 means I have a 60 chance of getting a loan. Enter the maturity in days of the strategy ie. Web Using the calculator you enter the price of each option to see that a July 290-285 bull put spread could be sold for around 050 cell C21.

Ad Patented Options Search Engine. Web We have created a Foreign Exchange Spread calculator for traders. Web Now using the same expiration date and stock price below is an image for selling the 4540 bull put spread.

Learn To Make Spread Income With Options. Hence the credit spread in this example is 53 - 18 35. Free TrialNo Credit Card.

Web The rate spread calculator generates the spread between the Annual Percentage Rate APR and a survey-based estimate of APRs currently offered on prime mortgage loans of a comparable type utilizing the Average Prime Offer Rates fixed or. 130 045 Buy to Open price of the option you are buying. Web Credit Spread bond 1 Recovery Rate Default Probability Credit spreads vary from one security to another based on the credit rating of the issuer of the bond.

Ad Patented Options Search Engine. Learn More About American Funds Objective-Based Approach to Investing. This can be done by using the credit spread formula below.

Suutinqd0m Esm

Rainbow High Mini Accessories Studio Shoes 25 Mystery Fashion Collectibles Assortment Very Co Uk

Calculate Profit Loss For Credit Spreads Options Trades By Damocles

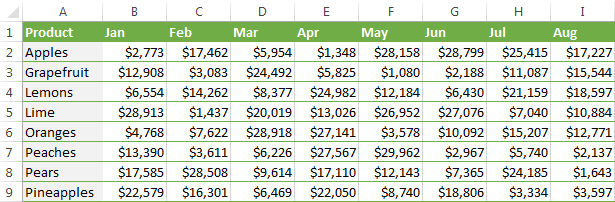

Excel Vlookup With Sum Or Sumif Function Formula Examples

Bull Put Spread Calculator 2020 Update

Global Service Providers Guide 2022 By Chemical Watch Issuu

Calculate Profit Loss For Credit Spreads Options Trades By Damocles

Premarket Trading Everything You Need To Know The Motley Fool

Options Spread Calculator

Credit Card Terminology Cheat Sheet 25 Definitions

What Is A Credit Spread Definition For Bonds And Options Ig Uk

July 2021 Market Commentary Etf Strategist Channel

Take Advantage Of Volatility Spikes With Credit Spreads

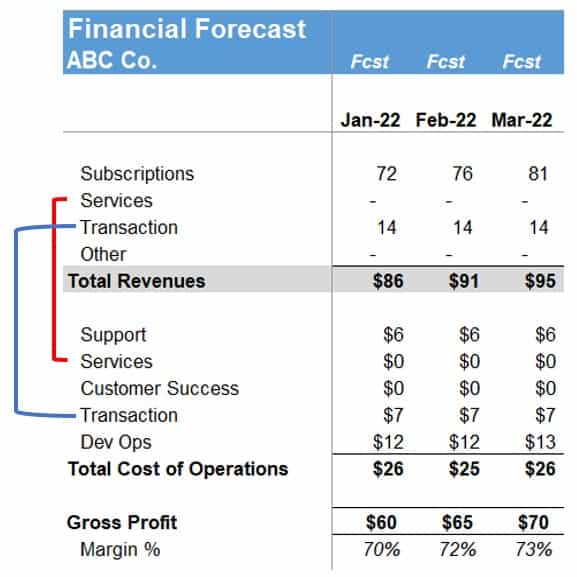

How To Correctly Calculate Your Saas Gross Margin The Saas Cfo

Ecfr 12 Cfr 3 132 Counterparty Credit Risk Of Repo Style Transactions Eligible Margin Loans And Otc Derivative Contracts

A B Testing The Complete Guide With Expert Tips 2023

Using The Free Trade Calculator To Profit On Credit Spreads Option Party